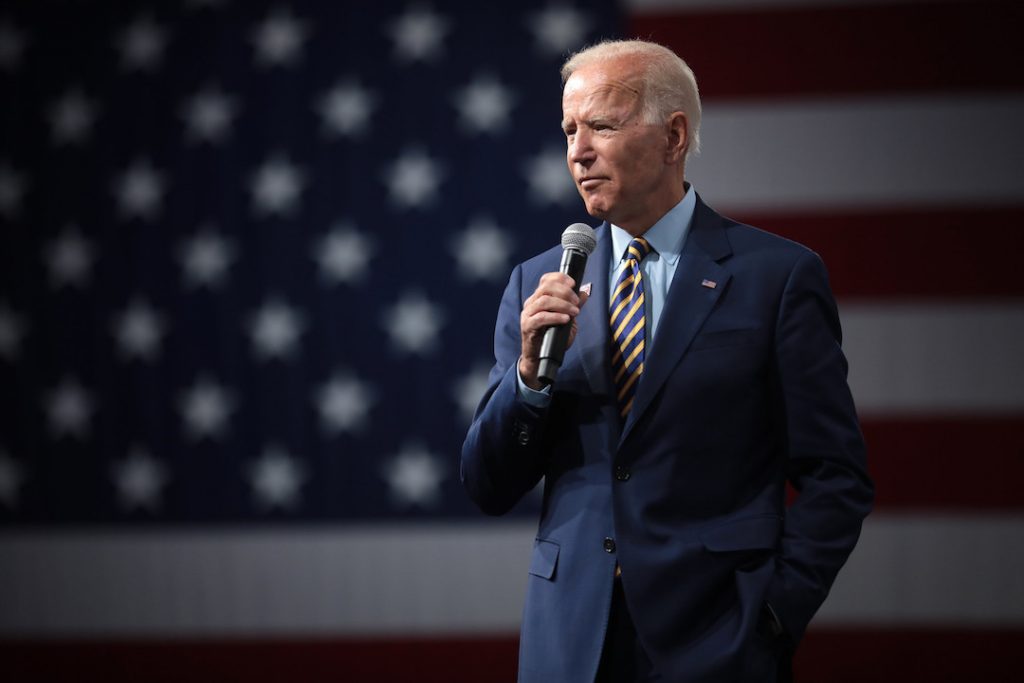

Presidential candidate Joe Biden is proposing a critical change to employer-sponsored 401(k) plans: giving everyone a percentage tax credit based on how much they contribute.

This may encourage low-income earners to save for retirement, but it would also likely reduce the financial benefit for high-income individuals, who may then choose to take advantage of a Roth 401(k) — or, after-tax plan.

Here’s what you need to know.

Traditional 401(k) plans allow employees to contribute pre-tax, earned income to investment accounts; in other words, the money they invest is not taxed and can take advantage of tax-deferred growth.

“The higher your tax bracket, the more benefit you get for contributing the same amount of money,” says Kelly Campbell, chairman, and CEO of Campbell Wealth Management in the Washington, D.C. area.

Depending on your tax rate, your tax advantage can differ greatly.

“Someone in the 37 percent bracket will get a tax savings of $7,215 [on a $19,500 contribution for the year],” says Campbell. “For someone in the 10 percent bracket, that same $19,500 contribution will receive a $1,950 benefit.”

Under Biden, the tax credit for 401(k) contributions would be based on how much an individual contributes, not their tax bracket. The specific tax credit is not yet fully detailed.

It’s predicted that many high-income earners will decide to move from a Traditional 401(k) to a Roth 401(k), in exchange for free tax growth and withdrawals in the future. Highly compensated employees may decide a Traditional 401(k) isn’t worth the tax break.

Roth plans also protect against paying future taxes because the money invested is already taxed. Depending on a person’s tax rate now, and expected tax rate in the future, plays a critical role in selecting a Roth or Traditional 401(k) plan.

“Contributing to a Roth eliminates the uncertainty of future tax liability,” says Skylar Riddle, a financial adviser at Fort Pitt Capital Group in Pittsburgh. “Once you already have money in the account, the direction of future rates matters less, if at all, because you won’t be paying taxes on your withdrawals anyway.”

With this in mind, many young and low-tax rate individuals may already opt for a Roth 401(k) anyway.

Biden’s plan may not actually help as many low-income earners as planned, because so many are living paycheck to paycheck. If they have incurred debt, it may be more financially responsible to pay down the debt first, before investing.

All of this is speculation, but it’s good to be informed.

Saveday can get you prepared for either scenario. Whether you need a Roth or Traditional 401(k) plan, all Saveday plans allow investments to Grow Freely! Find out how, today.