This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Domino's Franchisee Association

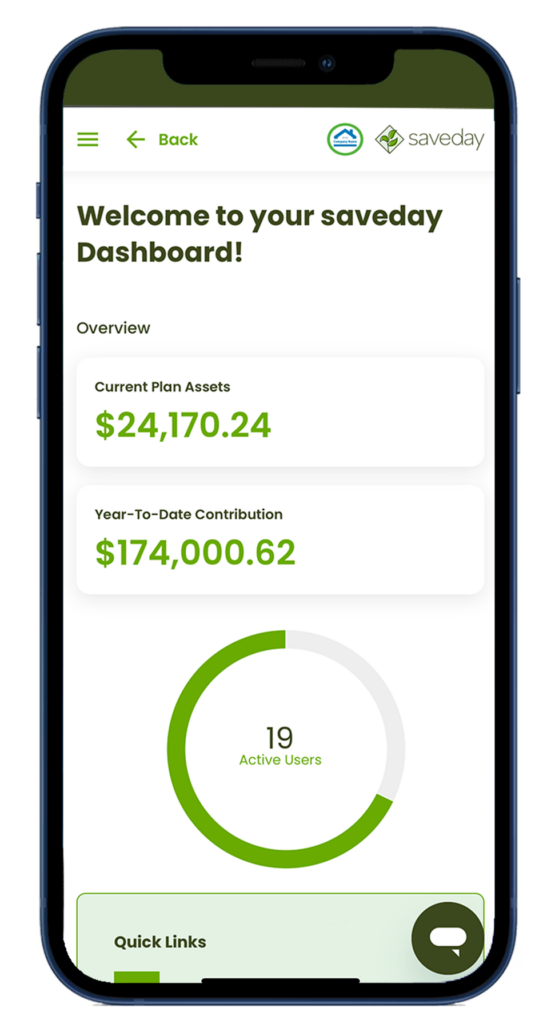

Save time, money, and the administrative headache of offering retirement plans with Saveday’s $0 employer-cost, no-hassle plans.

What a Domino's Owner Says!

Nearly 38 Million Americans, working for small businesses, have zero access to retirement benefits.

Finding affordable retirement benefits can be a headache. Spending thousands in start-up costs and losing time to the administrative burden of setting up a plan only to find limited plan offerings with high fees for participants?

There’s a better way: Saveday is the $0 employer-cost, no-hassle solution for you and a path to financial security for your employees.

Zero Hassle. $0 Employer-cost. 401(k) Solved. That’s the Saveday way.

Setup takes just 15 minutes or less, so you can quickly solve your employee retirement benefits needs and get back to doing what you do best: running your business.

We charge one low fee, keeping more money in your and your employees’ pockets. There is no per-employee fee, no monthly fee to the business, and no setup fee.

The All-in-One, No Hassle 401(k) Solution

- 15-Minute or Less Setup

- Full-time Employees

- No Hidden Fees

- No Confusing Options

- Part-time Employees

- Auto Enrollment

- State Mandate Approved

- High Turnover, no Issue

- Easy Payroll Integration

A Fully Bundled 401(k) Solution That Does all the Heavy Lifting, and Then Some

Fiduciary Services

We have built-in fiduciary guidance and act as your ERISA 3(16) and 3(38) fiduciary. We ensure your plan is created and managed according to ERISA requirements.

Recordkeeping

We track your 401(k) plan’s balances, transactions, withholdings, and deferrals.

Government Filings

We prepare annual reports for no extra fee, including Form 5500 and 8955. There is no busy work for your overtaxed HR staff.

IRS Nondiscrimination Testing

We perform nondiscrimination testing and manage any required corrections. Our compliance-friendly Safe Harbor plans are also available to any business.

Managed Investments

Through our affiliated investment adviser, WealthyX, LLC, your employees can access advised, customized portfolios suited to their individual risk appetite and goals for just one low AUM fee of up to 90bps (0.90%).

Custodial Services

As the broker-dealer, we work directly with a third-party custodian to validate transactions and execute trades. Your 401(k) plan takes advantage of the savings.

Plan Setup is a Breeze

Setup takes 15 minutes or less and consists of three easy steps.

1) Provide Your Business’s Information

2) Start with the Basics

Traditional 401(k)

Employees’ earned pre-tax dollars fund it and allow for optional employer-matching contributions. Any withdrawal is subject to taxation, even in retirement.

Roth 401(k)

The plan is funded by employees’ earned after-tax dollars and allows for employer-matching contributions. Any withdrawals at/during retirement are tax-free. The account must have been open for at least five years before withdrawing money.

3) Customize Your Plan to Your Business’s Needs

Profit Sharing

Design your plan so you can make discretionary contributions to your employees’ 401(k) accounts. Learn more

Employee optional feature.

Employer Matching

Recruit and retain top talent with an incentivizing employer match option. Learn more

Employee optional feature.

Vesting

Construct your plan with the option for employees to earn the right to keep employer contributions after a predetermined employment period. Learn more

Employee optional feature.

Safe harbor

Safe Harbor plans allow for high levels of contributions by employees and are exempt from non-discriminatory testing from the IRS. Employer contributions are always mandatory. Learn more

Automatic Enrollment

Give your employees the push they need to begin investing in their retirement. Learn more

Non-optional feature with easy, 60-second, voluntary employee opt-out function.

How Your Business Benefits

from Offering a 401(k)

- Attract and retain talent: A 401(k) plan is a highly valued benefit that can help small businesses compete for and retain top talent by enhancing the overall compensation package. Offering a 401(k) plan demonstrates a commitment to employees’ long-term well-being and financial security, which can boost morale, satisfaction, and loyalty. With a 401(k), employees benefit from tax-deferred growth of their investments, which is attractive for top talent.

- Tax advantages for employers: Contributions made by the business to employees’ accounts are tax-deductible, reducing the company’s taxable income. Additionally, small businesses may qualify for tax credits to offset costs associated with starting a new 401(k) plan.

- Encourage retirement savings: A 401(k) plan makes it easier for employees to save for retirement through automatic payroll deductions, potentially with employer-matching contributions to boost their savings.

- Potential tax credits: Small businesses that set up a new 401(k) may be eligible for tax credits to offset setup and administrative costs.

- Flexibility in plan features: Employers can choose from various plans and features, allowing for easy customization based on business and employee needs.

- Personal retirement savings: Small business owners can also participate in the plan, allowing them to save for their retirement while benefiting from the same tax advantages and employer contributions.

How Employees Benefit from

Opting Into a 401(k)

- Tax savings: Contributions are made pre-tax, reducing taxable income for the year. Roth options may also allow for tax-free withdrawals in retirement.

- Employee matching: Many small businesses offer matching contributions up to a certain percentage, effectively providing additional money in employee retirement savings without them having to work extra.

- Tax-deferred growth: Investments grow tax-deferred within the 401(k), meaning no taxes are paid on earnings until withdrawals begin.

- Compound growth: The earlier employees start saving, the more they benefit from compound interest, significantly increasing their retirement fund over time.

- Retirement readiness: A 401(k) helps employees systematically save for retirement, ensuring financial stability later in life.

- Portability: If employees leave the company, they can roll over their 401(k) into another plan or an individual retirement account (IRA), keeping their retirement savings intact.

- Loan and hardship withdrawals: Some plans allow for loans or hardship withdrawals, offering financial flexibility in emergencies. However, these features are plan-specific and often have financial implications.

- Automatic savings: Payroll deductions automate the savings process and make it easier for employees to contribute to their retirement savings plan.

- Vesting benefits: Employer contributions may vest over time, adding to the employee’s retirement savings as a reward for job tenure.

- Financial planning resources: Many 401(k) providers offer educational resources and tools to help employees plan for retirement and make financial planning more accessible.

- Diverse investment choices: 401(k) plans often offer a range of investment options, allowing employees to diversify their portfolios according to risk tolerance and investment goals.

Frequently Asked Questions

With automatic enrollment, employees are enrolled by the employer in a 401(k) when eligible. The employer sets a default contribution rate and invests contributions in a default investment fund until the employee chooses differently or opts out.

Saveday made it radically easy for employees to opt-out at will, and the process takes 60 seconds for most people.

Note that all new 401(k) plans that started after Dec. 29, 2022, must be converted to an automatic contribution arrangement (ACA), along with any new plans beginning in 2024. After that, all plans must include auto-enrollment.

Businesses are generally only obligated to match 401(k) contributions if they opt for a plan design that explicitly requires an employer match or if state mandates require it. This flexibility allows them to choose whether to implement matching contributions based on their financial capacity and business goals. Understanding this choice is critical for employers as they design their retirement benefits strategy to best suit their business needs and the needs of their employees.

For example, with a Safe Harbor 401(k), employers must make fully vested and matched contributions to employees who contribute. Another option is to make non-elective contributions to all eligible employees, regardless of participation.

Note that the non-elective contributions are not salary matches but rather a percentage of an employee’s pay contributed on behalf of the employee.

Employers often offer matching to attract and retain talent. In addition, they may also use these contributions as an incentive to encourage employee participation in 401(k) plans and promote a culture of saving and financial security. For many small businesses, contribution matching requires careful budget planning.

A Safe Harbor 401(k) plan enables companies to bypass the regulations and expenses of the nondiscrimination tests typically required for a traditional 401(k) plan. With Safe Harbor 401(k) plans, an employer must contribute by matching employee contributions, making non-elective payments of 3% of an eligible employee’s compensation plan, or paying more than the employee to the plan. The contribution from the employer must also be fully vested when made.

Profit-sharing is a feature where employers make discretionary contributions to their employees’ retirement accounts based on company profits. The option adds flexibility, enhances employee benefits, and offers tax advantages for the business. Profit-sharing can be a powerful tool for aligning employee interests with business success. However, profit-sharing requires transparent communication and sound financial management to ensure contributions are sustainable and meaningful for employees.

Profit-sharing is an optional feature offered on all new plans.

Vesting is when employees earn the right to keep employer contributions after a certain employment period. Vesting periods stipulate the time employees must work before they fully own the funds in their retirement account contributed by the employer.

Vesting schedules determine how long employees must stay with a company to earn full rights to their retirement benefits. This option encourages longer tenure while offering a clear timeline for benefit accrual.

There are two main types of vesting schedules:

- Cliff: Cliff vesting is where employees are 100% vested after a specific period. Typically, it is within three years of employment, as per IRS rules. If an employee leaves before this period, they forfeit the unvested portion.

- Graded: Graded vesting allows employees to gradually vest over time, becoming fully vested over up to six years. For example, an employee might be 20% vested after two years, with an additional 20% each subsequent year.

Vesting is an optional feature offered on all new plans.

The specific rules and schedules vary and depend on the employer’s plan. IRS regulations set maximum limits for vesting schedules, but employers can offer faster vesting if they choose. Employee contributions are always 100% vested immediately.

Employees who contribute to a 401(k) should consider personal financial situations, retirement goals, and the specific features of their plan. Here are some key considerations:

Employer match: Many employers match 401(k) contributions up to a certain percentage of an employee’s salary. Employees should contribute enough to get the full employer match to maximize the plan’s benefits.

Retirement goals: Contributions should match goals that align with an employee’s desired retirement lifestyle. Various online calculators can help estimate how much a person needs to save to meet retirement income goals.

Average savings: A common rule of thumb is to save between 10-15% of pre-tax income for retirement, which includes employer contributions. The IRS allows individuals to contribute up to $20,500 to their 401(k). Individuals aged 50 and over can make additional catch-up contributions of $6,500. If financially feasible, maxing out contributions can significantly impact retirement savings’ growth, thanks to tax advantages and compounding interest over time.

Is Saveday free (too good to be true)?

Stated plainly: Our plans are not free, of course. However, the business does not pay any fees as long as there are active participants.

We believe that it is only fair for participants using the plans to pay a low AUM fee of up to 90bps (0.90%). This criterion also applies to business owners who participate in the plan.

By saving money in this way, the business can invest the savings in optional contribution matching or other methods of employee betterment if you choose to do so. The model also enables small businesses that cannot afford a 401(k) plan loaded with fees by our competitors to finally offer retirement benefits.

What about high turnover or part-time employees?

We Handle Part-Time with Ease

We don’t distinguish between full-time and part-time. It is a great benefit for everyone because we all need to save for retirement.

Because of our unique model and technology stack, there’s no cost to you. Plus, offering to everyone reduces your liability.

We Handle Departed Employees

When employees leave, there's nothing for you to do.

We expertly take care of the former employee and guide them through managing their account going forward.

Our Customers LOVE Us!

Get Ahead of State Mandates!

Better Contribution Limits

State plans offer IRAs, with low annual contribution limits. 401(k)s have a limit of $22,500, giving employees much more room to grow their portfolio.

Avoid Penalty Fees

Multiple states are already penalizing businesses who don't comply with their requirements or miss enrollment deadlines.

All Work, No Pay

State plans require the employer to do their own plan administration, including compliance, while exposing their business to fiduciary risk. With Saveday, there's no hassle and risk is greatly minimized.

Questions? Schedule a time with Keith...

Keith Page has nearly 25 years of management experience, including 10 years in the financial planning industry. While he loves working with families, his specialty has been working with small business owners. To progress his career, he became a Registered Representative by acquiring his SIE, Series 6, and Series 63 licenses.

Keith joined Saveday due to the mission: Make 401k’s affordable and hassle free so more people can retire secure. Now Keith has the pleasure of working with small business owners across all 50 states, and helping them set up their very own easy and affordable qualified retirement plan.