This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

U-Haul Dealer Benefits Partnership

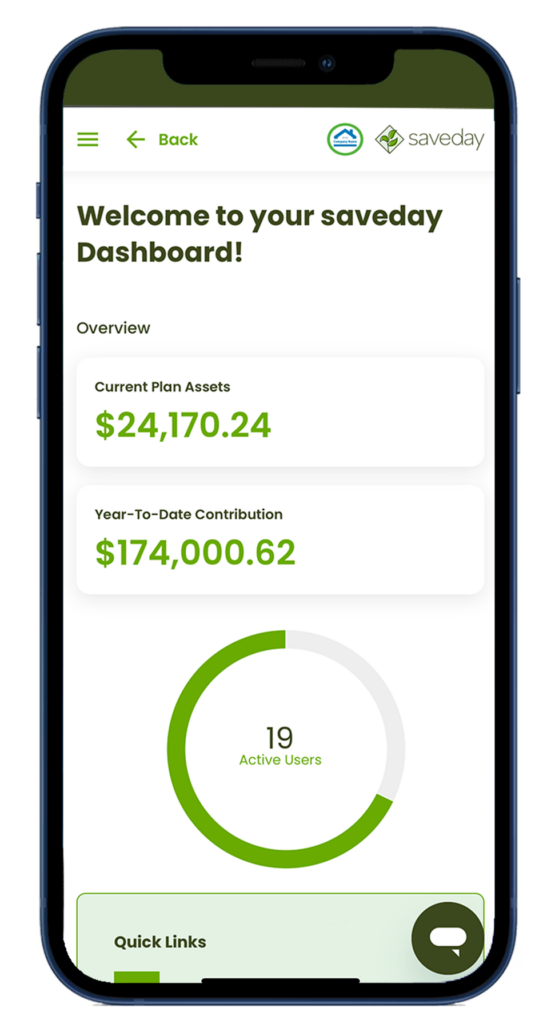

Save time, money, and the administrative headache of offering retirement plans with saveday’s $0 employer-cost, no-hassle plans. Enjoy even higher levels of efficiency, accuracy, and cost savings by bundling your payroll + retirement benefits with a Pooled Employer Plan, sponsored by Horizon!

Nearly 38 Million Americans, working for small businesses, have zero access to retirement benefits.

Finding affordable retirement benefits can be a headache. Spending thousands in start-up costs and losing time to the administrative burden of setting up a plan, only to find limited plan offerings with high fees for participants? There’s a better way: saveday is the $0 employer-cost, no-hassle solution.

Meet Horizon Payroll, U-Haul Dealer Benefit's preferred payroll partner.

To offer a one-stop, easy solution for U-Haul dealers like you, Saveday and Horizon Payroll teamed.

By switching your payroll to Horizon, you can enjoy even higher levels of efficiency, accuracy, and cost savings. Horizon’s automated payroll system allows business owners to focus on building their business instead of spending their time on custodial tasks.

Why Pooled Employer Plans Work for U-Haul Dealers

Traditional employer-managed 401(k)s are a hassle for most small business owners. They’re costly and come with fiduciary responsibilities, plan management requirements, and administrative duties.

Pooled Employer Plans (PEP) offer an alternate path where multiple employers participate in one plan. The fiduciary responsibilities, plan management, and administrative duties are handled by a third party (Saveday and Horizon Payroll in this case).

That means it’s much more affordable, and we take care of all the headaches so you can get back to doing what you do best — taking care of your customers.

What if I already have a payroll provider?

Saveday offers other solutions for you if you already have a payroll provider and a PEP isn’t right for your business. Contact us today, and we can help you take the next steps.

Retirement Benefits – the Saveday Way

Compliance Services

Join Horizon Payroll's PEP and enjoy complimentary record-keeping, fiduciary, and compliance services - without the fiduciary risk!

Payroll Integration

Saveday integrates directly with Horizon's payroll to securely access and process contributions. You don't have to lift a finger!

Auto-Enrollment

Opt-out models dramatically increase participation and simplify on-boarding, helping your employees save for retirement without the hassle.

Our Customers LOVE Us!

Get Ahead of State Mandates!

Low Contribution Limits

State plans offer IRAs, with low annual contribution limits. 401(k)s have a limit of $22,500, giving employees much more room to grow their portfolio.

Avoid Penalty Fees

Multiple states are already penalizing businesses who don't comply with their requirements or miss enrollment deadlines.

All Work, No Pay

State plans require the employer to do their own plan administration, including compliance, while exposing their business to fiduciary risk.

You’re just a few steps away from offering $0 employer-cost retirement benefits with SaveDay!

Get in compliance, or get ahead of the curve, by switching to Horizon and joining their zero employer-cost, state-compliant Pooled Employer Plan through saveday today.

Complete the following form and we’ll be in touch within one to two business days to get you set up fast. It’s that easy – seriously!

Please note: We are only able to provide benefits to US based companies at this time.

Note: By inputting your information, you agree to accept phone calls from Saveday and/or Horizon Payroll.