Hi, I’m Emma, a recent-ish college graduate just starting out in the “real world.” Join me on my journey from “Ramen to Retirement”: how I’m learning to budget my new corporate lifestyle and set myself up for retirement (starting by enrolling in my 401(k)…who knew?).

Step One: Acknowledging you (I) have a Problem

It all began when my dad read an article about how Gen Z was saving up more in retirement than any previous generation. He asked, “How much have you saved up so far?” Just between us (dear reader), the only thing resembling budgeting that I had done in the past few weeks was stop myself from getting panda express for the billionth time.

He asked if I had enrolled in a 401(k) through my job. I had not. Don’t blame me, I had no idea how 401(k)s worked! Of course, I knew that I was supposed to have one eventually. I just didn’t know that eventually was really more like yesterday.

A quick perusal of my cluttered inbox revealed that my job had sent quite a few emails about enrolling in my 401(k) – whoops. Those emails explained that a 401(k) is an account that you can only get through your job. It helps you save for retirement by investing money straight from your paycheck into different funds and stocks. The longer you have until retirement, the more potential growth your account can have – perfect! At least I hadn’t waited too late to start saving.

Weird to think it could even be considered starting “late” when retirement seems SO far away, right?

Saveday, the company my employer is sponsoring the 401(k) with, had emailed as well. They promised simple enrollment in fifteen minutes or less. We’ll see about that. Becoming an investing expert in just 15 minutes? 15 minutes ago, I didn’t know what a 401(k) was.

Step Two: Taking Action… (Finally) Enrolling in my 401(k)

Alright, enough excuses. Time to see what this 401(k) situation was all about.

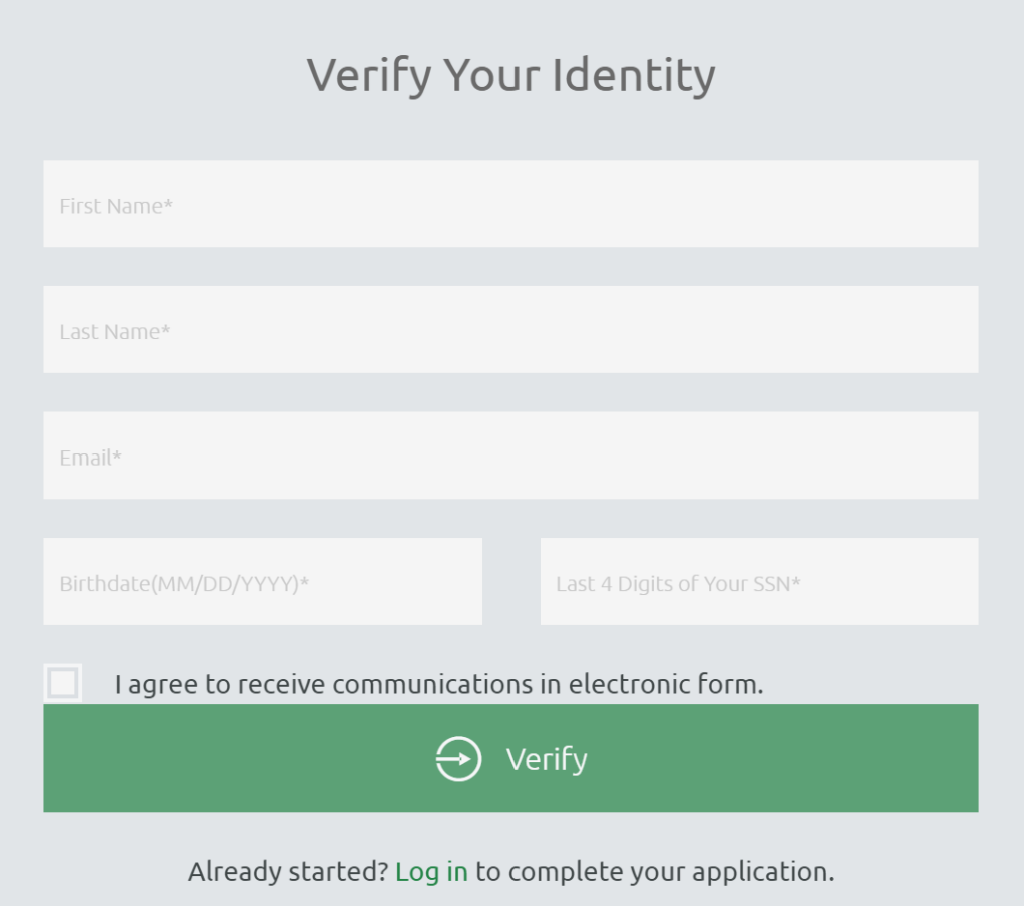

Clicking on the personalized link in saveday’s email took me straight to the enrollment page.

As a proud full-time adult with my Social Security Number memorized 💁♀️, it took less than a minute to start my account.

From there, I was asked a few questions about when I wanted to retire and how much risk I was comfortable with as an investor. I wasn’t sure how much risk would be best. Luckily, there was an assessment built into the process that helped explain what kind of portfolio was right for me. It also explained the difference between Roth and Traditional accounts and the types of investments saveday makes. I was surprised by how much I learned about retirement planning and investing just by enrolling!

Next, the contribution calculator walked me through deciding what percentage of my paycheck to contribute to my account each month. With saveday, you can change your contribution level at any time, which made me feel better about taking home less in my paycheck each month. Especially when I learned that saving for retirement is like running a marathon. Slow and steady wins the race!

Step Three: “Adulting” Achievement Unlocked!

And, voila! After selecting a contribution percentage, my account was set up and ready to receive contributions. Saveday automatically processes contributions each pay period directly through employer’s payroll. It’s super helpful that the money goes straight from my paycheck into my account.

Now my money is working hard for me, and I don’t have to lift a finger!

Saveday has a dashboard so you can visually see what your money is doing. It’s pretty fun to look at. The bar graphs and pie charts show how much your money grows each month and where your assets are invested. Even though I’m not the one moving the money around, it makes me feel like a financial guru. (Wolf of Wall Street, who???)

Realizing I had nearly missed the boat on learning about and enrolling in my 401(k) made me curious about what else I was missing in terms of finance and investing – so I’m going to find out. Come along as I continue taking baby steps toward becoming a full on r/personalfinance-level genius (okay, or at least a zillennial with a diverse investment portfolio).

If you aren’t still sure where to start, or want to learn more about 401(k)s before enrolling, the saveday website has lots of educational resources about 401(k) terms and common questions about 401(k)s available to check out.

See you next week!

-Emma