At saveday, we take our fiduciary responsibility seriously. When you entrust your retirement savings to us, we prioritize transparency, security, and expertise. Our goal is to provide you with a seamless and reliable investment experience while meeting and exceeding the highest regulatory standards. Let’s explore how we fulfill our fiduciary duty to protect your retirement investments:

Highly Regulated and Transparent:

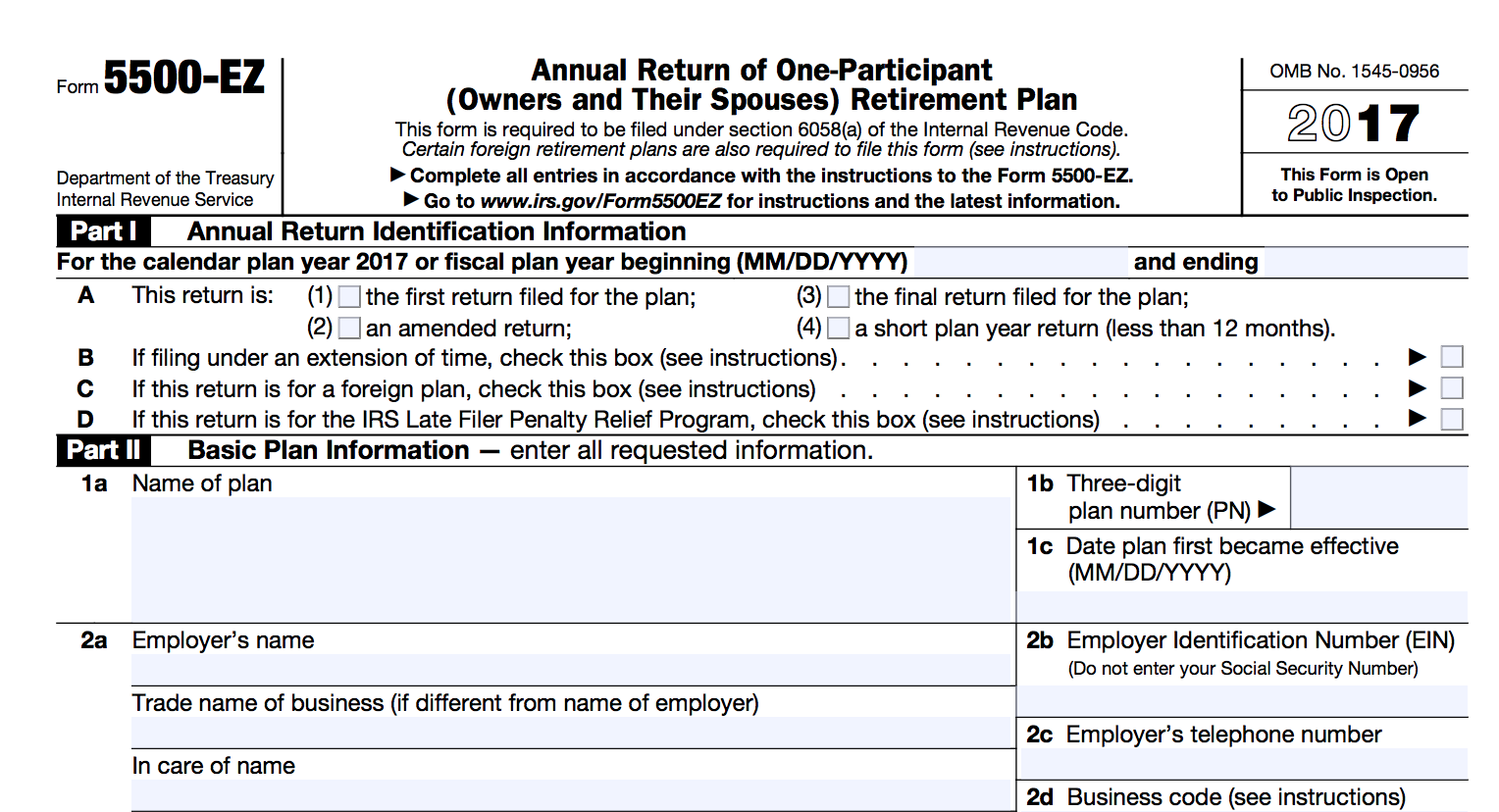

We’ve integrated the advisory, broker/dealer, and administrative functions into one comprehensive product. This approach allows us to operate under the watchful eye of regulatory bodies such as FINRA, SEC, ERISA, IRS, and DOL. Transparency is a key principle, and you can easily find information about our advisory business and leadership on the SEC’s official website (sec.gov). Likewise, our broker/dealer history and disclosures are accessible on finra.org.

Clearing House Relationship:

To enhance security, saveday doesn’t hold custody of your assets. Instead, we partner with APEX Clearing, a trusted asset custodian serving millions of users and managing billions of dollars in assets. This seamless integration ensures efficient financial operations and provides peace of mind. APEX also serves as a clearing house for other leading FinTech institutions like Stash, SoFi, and FirstTrade.

Asset Security:

When you invest with saveday, your accounts are protected through our custodian clearing company, APEX. We offer SIPC insurance coverage of up to $500,000 per account, along with additional third-party insurance of $1,000,000 per account. Rest assured that your hard-earned savings are in safe hands.

Data Security:

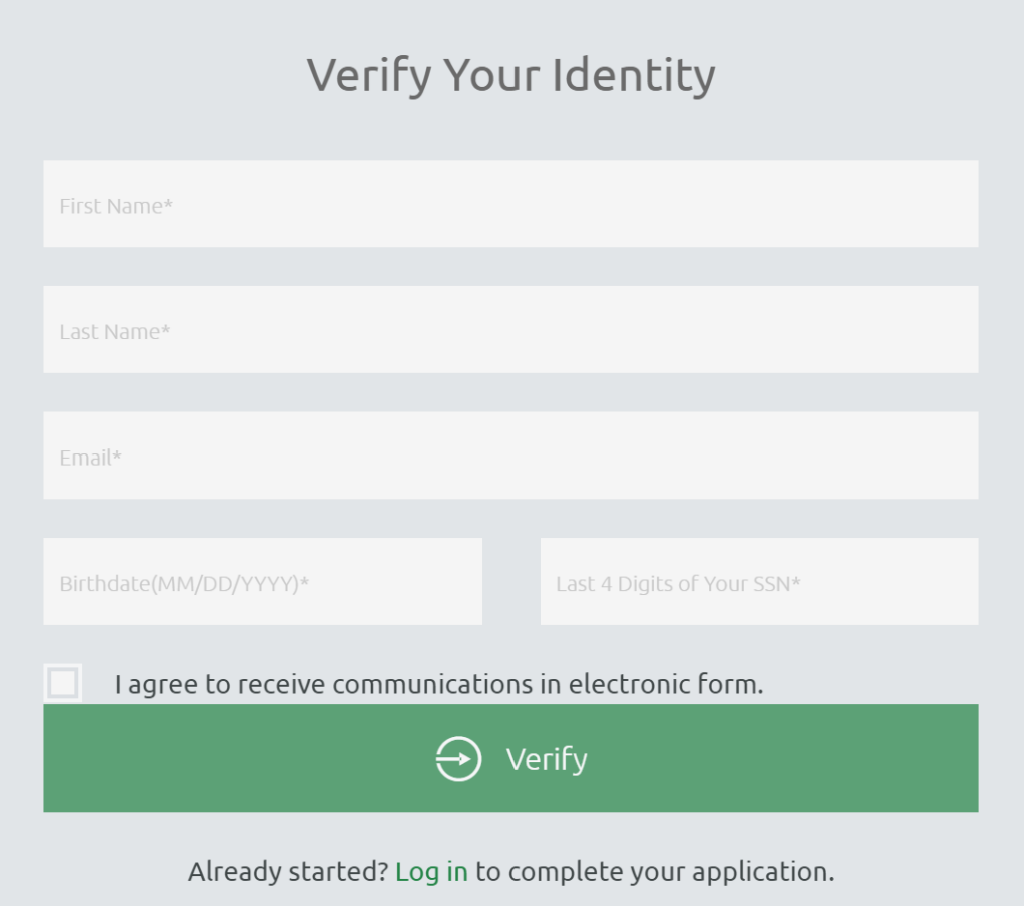

We prioritize the security of your data in line with FINRA and SEC guidance. Our robust data security protocols include annual penetration testing and data encryption. By handling only ACHs from trusted payroll providers and adhering to SOC 2 protocols for asset delivery, we minimize the risk of fraud and ensure the confidentiality of your information.

Diversified Portfolios & Brand Name ETFs:

We follow Modern Portfolio Theory (MPT), a Nobel Prize-winning investment approach. Our diversified portfolios consist of low-cost Exchange-Traded Funds (ETFs) covering major asset classes like US Stocks, International Stocks, US Bonds, International Bonds, and US TIPS. These ETFs, managed by industry leaders, have minimal tracking errors and high liquidity. Our proactive portfolio monitoring and rebalancing strategies align with your long-term goals.

Saveday’s Regulatory Principal:

Barry Mione, our Regulatory Principal, brings over 25 years of experience in creating financially efficient products. With his background as the founder of DLJdirect (now E*Trade) and his expertise gained at Credit Suisse, BMO, and BNY Mellon, Barry ensures that saveday adheres to the highest regulatory standards. You can trust that your retirement savings are in capable hands.

At saveday, safeguarding your retirement investments is our top priority. We strive to provide you with a secure, transparent, and expertly managed investment experience. With our highly regulated platform, trusted clearing house relationship, asset and data security measures, diversified portfolios, and the guidance of our experienced Regulatory Principal, you can have peace of mind knowing that saveday is dedicated to protecting your financial future. Trust us to fulfill our fiduciary duty and help you achieve your retirement goals.