If you’re an HR administrator, Benefits Coordinator, or small business owner, you might be a 401(k) plan sponsor. If so, you may have heard about the ERISA Fidelity bond. This article will help you understand what it is, who it covers, and why it’s crucial for Department of Labor compliance.

What is an ERISA Fidelity bond?

ERISA or the Employee Retirement Income Security Act, provides guidelines for private sector employee benefit plans. This includes 401(k)s and other defined contribution plans. ERISA also covers those who manage and invest plan assets.

In 1974, the U.S. Department of Labor introduced ERISA. Why? To address public worries about the mishandling of private pension funds and other employee benefit plans.

One requirement of ERISA stands out. Those who handle plan funds and other assets must have a fidelity bond. This bond helps protect the plan from fraud-induced losses.

Simply put, an ERISA Fidelity Bond is like insurance. It protects workers’ retirement savings from fraud or dishonest acts.

Who needs to be bonded?

According to Department of Labor (DOL) regulations, if you handle plan funds or assets, you must be bonded.

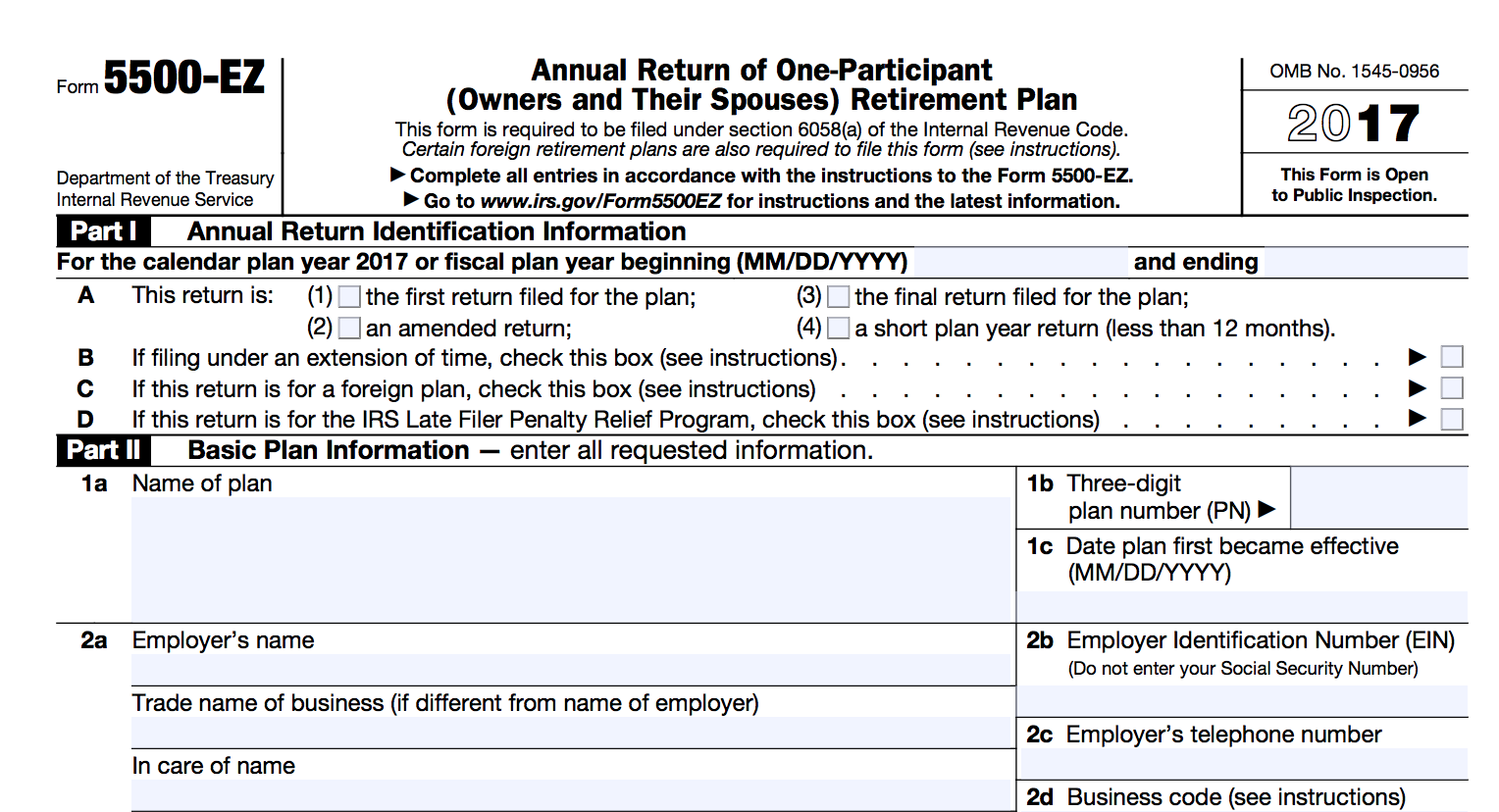

How much coverage is necessary?

You need Fidelity Bond coverage equal to at least 10% of plan assets. However, the bond amount can’t be less than $1,000. And the Department won’t require a bond of more than $500,000. Or $1,000,000 for plans with employer securities. These amounts apply to each plan listed on a bond.

How can I purchase a bond?

Bonds can be procured from a surety or reinsurer listed on the Bureau of the Fiscal Service’s Certified Companies roster.

Saveday has teamed up with Colonial Surety Company to help clients secure the correct bonding. If you need to purchase an ERISA Fidelity Bond for your plan, you can click here to conveniently buy a bond today.*

For further details on ERISA Fidelity Bonds, you can access the “Fiduciary Responsibilities” PDF via the Department of Labor here.

*saveday is an affiliate of Colonial and earns commission on referrals.