Welcome, savvy savers, to an insightful exploration of retirement savings options! Today, we’ll dive into the realm of Individual Retirement Accounts (IRAs) and compare them with the game-changing saveday 401(k). By the end of this informative journey, you’ll be equipped with the knowledge to make an informed decision and pave the way for a financially secure future.

IRAs: Versatility with Limitations

Individual Retirement Accounts (IRAs) offer a range of advantages and disadvantages. On the positive side, IRAs provide individuals with flexibility, allowing contributions even outside of employer-sponsored plans. (Meaning you don’t have to get one through your job.) They offer a variety of investment options and can be self-directed, giving you control over your retirement funds.

However, IRAs have contribution limits that may restrict your ability to save larger sums. Additionally, they lack the benefits of employer matching contributions that can boost your savings potential.

Saveday 401(k): Revolutionizing Retirement Savings

Now, let’s explore the distinctive features of the 401(k) that sets it apart as an exceptional choice for your retirement savings:

- Enhanced Contribution Limits:

401(k)s offer higher contribution limits compared to IRAs, allowing you to save more for retirement. By maximizing your contributions, you can accelerate your savings growth and build a more substantial nest egg. This increased capacity sets the stage for a more financially abundant retirement.

- Employer Matching Contributions:

One of the standout advantages of the 401(k) is the potential for employer matching contributions. This means that for every dollar you contribute to your 401(k), your employer may match a portion of it. Employer matches represent free money towards your retirement savings, amplifying your investment potential and boosting your long-term financial security.

- Streamlined Administration:

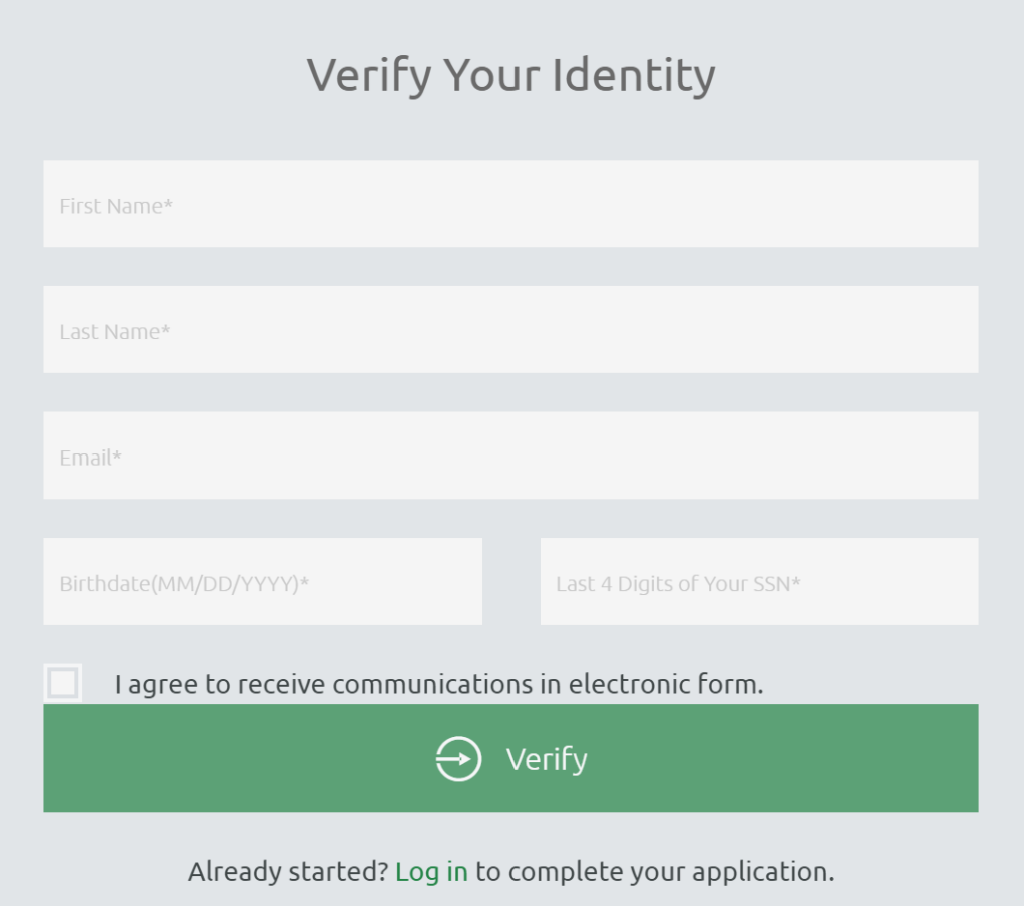

Saveday takes the complexity out of managing your retirement savings. Our user-friendly platform simplifies administrative tasks, automates processes, and offers seamless integration with payroll systems. This streamlined approach saves you time and effort, allowing you to focus on what truly matters – while growing your retirement funds.

- Simplified Investment Options:

Saveday uses ETFs, which are like a basket of securities, including stocks and bonds and other assets, that can be traded whenever the markets are open. ETFs combine the diversification benefits of mutual funds with the ease of stock trading. This approach is a simple way to access the financial markets without having to pick assets yourself, and the diversity of the securities enhances your potential for long-term growth and financial success.

When it comes to navigating retirement savings, the choice between IRAs and 401(k)s is a crucial one. While IRAs provide versatility, 401(k)s empower you with enhanced contribution limits, potential employer matching contributions, streamlined administration, and simplified investment options.

Focus your financial future and choose a saveday 401(k) to unleash the full potential of your retirement savings. With saveday, your retirement journey becomes an exciting and rewarding adventure. We look forward to being your trusted partner in building a prosperous future.